Stepping into the realm of real check here estate investment can feel daunting, overflowing with complex terminology and intricate strategies. However, understanding the core concept of real estate capital acts as your guiding light, illuminating the path to success. Real estate capital encompasses the various financial resources dedicated to acquiring, developing, or managing assets. It's the fuel that powers your ventures, allowing you to leverage opportunities and generate substantial returns.

Effective allocation of real estate capital is paramount. It involves strategically analyzing market trends, property values, and investment goals to determine the optimal distribution of funds. Whether you're targeting long-term appreciation or short-term cash flow, strategic capital plan is essential for navigating the dynamic real estate landscape.

- Utilizing debt financing to amplify your purchasing power can be a powerful tool in building a robust real estate portfolio.

- Thorough due diligence is crucial before committing capital, ensuring that every investment aligns with your risk tolerance and financial objectives.

- Cultivating strong relationships with reputable lenders, brokers, and contractors can facilitate the investment process.

Optimizing Real Estate Investments with Strategic Capital Partnerships

Real estate deployment can be a lucrative venture, but it often requires substantial capital. For optimal returns and mitigate risks, savvy investors are increasingly seeking out strategic capital partnerships. By collaborating with experienced lenders, developers and entrepreneurs can access the necessary resources to undertake larger-scale projects or grow their existing portfolios.

These partnerships offer a multitude of advantages. , Principally, they provide access to a wider pool of capital, which can be crucial for funding large-scale developments. Secondly, strategic partners often bring valuable expertise and industry connections to the table. This can help investors make more informed decisions, address complex challenges, and ultimately increase their chances of success.

Finally, capital partnerships can help risk mitigation by sharing financial responsibility among multiple parties. , In conclusion, by embracing strategic capital partnerships, real estate investors can amplify their potential for success and build a more robust and resilient portfolio.

Unlocking Value Through Real Estate Capital Strategies

In the dynamic realm of real estate, capital allocation serves a pivotal role in driving value creation and maximizing returns. By employing sophisticated capital strategies, investors can navigate market trends and generate substantial wealth.

A key element of successful real estate capital allocation is identifying high-potential opportunities. This involves a thorough evaluation of market fundamentals, property characteristics, and potential for escalation. Once attractive opportunities are pinpointed, investors can formulate capital strategies tailored to their aspirations.

Additionally, effective real estate capital strategies emphasize risk management and diversification. By allocating capital across different asset classes and geographies, investors can minimize portfolio risk.

Concurrently, staying up-to-date on evolving market conditions and regulatory changes is crucial for optimizing real estate capital strategies.

Charting the Real Estate Landscape: A Guide for Capital Partners

The real estate market presents a dynamic and often complex stage for capital partners seeking to generate returns. Successfully navigating this terrain demands a deep understanding of current market trends, thorough due diligence procedures, and a forward-thinking approach to deployment. Capital partners must carefully assess exposure, identify promising investment opportunities, and develop sound exit strategies to maximize their holdings.

- Fundamental factors influencing the real estate market include demographics,economic conditions,interest rates|supply and demand dynamics, regulatory policies, and technological advancements.

- Exploiting data analytics and market research is crucial for identifying profitable investment targets.

- Cultivating strong relationships with experienced real estate professionals, including brokers, lawyers, and contractors, can contribute invaluable to the investment process.

The Power of Real Estate Capital: Driving Portfolio Growth

Real estate capital serves as a potent driver for portfolio escalation. By leveraging the potential of real estate, investors can cultivate substantial and enduring returns. Diversification into real estate properties provides a buffer against volatility in traditional spheres. Furthermore, the tangible nature of real estate offers investors a sense of assurance that can bolster overall portfolio outcomes.

Carefully chosen real estate acquisitions have the capacity to generate both income and capital gains. As desire for quality real estate persists strong, investors can leverage on this dynamics to build a resilient portfolio. The key to success lies in conducting thorough research and choosing properties with strong future.

Creating Wealth Through Informed Real Estate Asset Distribution

Unlocking financial prosperity through real estate ventures necessitates a thorough approach to capital allocation. A savvy investor identifies undervalued properties, leveraging returns through risk management. By consistently applying time-tested strategies and adapting to market fluctuations, real estate investors can build a thriving portfolio that generates lasting wealth.

- Key considerations include: market trends.

- Rigorous due diligence minimizes risks associated with real estate.

- Harnessing financial tools such as loans can enhance investment potential.

Real estate remains a lucrative asset class for those seeking to build wealth. By adopting a strategic approach to capital allocation investors can themselves themselves for long-term financial success.

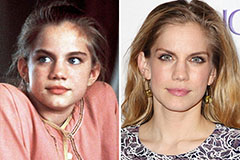

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Mike Vitar Then & Now!

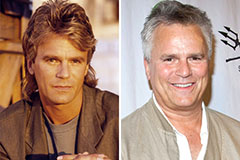

Mike Vitar Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!